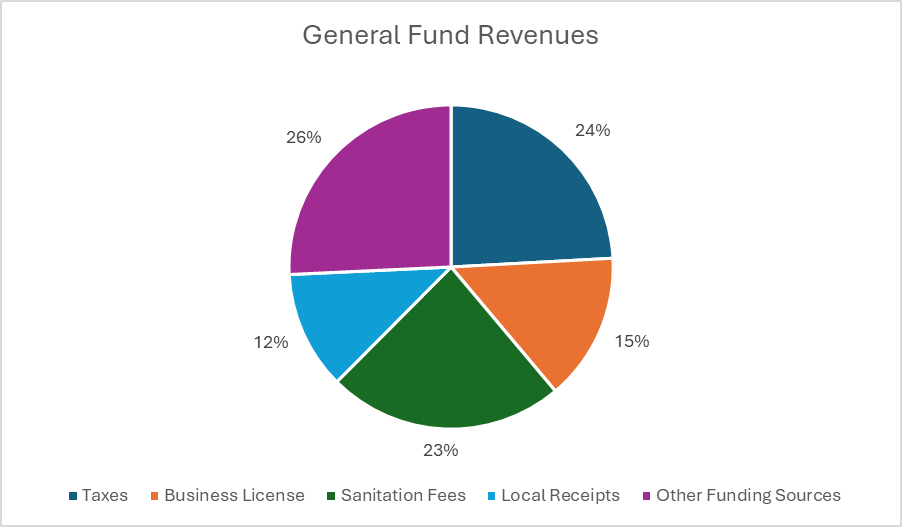

- Property Taxes account for 24% of our general fund revenues, about $1.02 million.

- Sanitation Fees, about $1 million, makes up around 23% of general fund revenues.

- Business Licenses is projected to be around $625,000 in FY 2026, accounting for 15% of the general fund revenues.

- Local Receipts, which make up 12% of the general fund revenues, are things like building permit fees, fines, accommodation taxes, recreation fees, park admissions and other monies that residents (and non-residents) pay to the city. The total dollar amount of local receipts in FY 2026 is projected to be around $500,000.

- Other Funding Sources includes things like franchise fees, grants, sale of capital assets and other miscellaneous income. The total from Other Funding Sources in FY 2026 is about $1.09 million, 26%.

Other funding that contributes to the General Fund are transfers from the Hospitality Tax fund to cover tourism, events and recreation expenses; and the Utility Fund to cover shared resources/general overhead.